nh property tax rates by town 2020

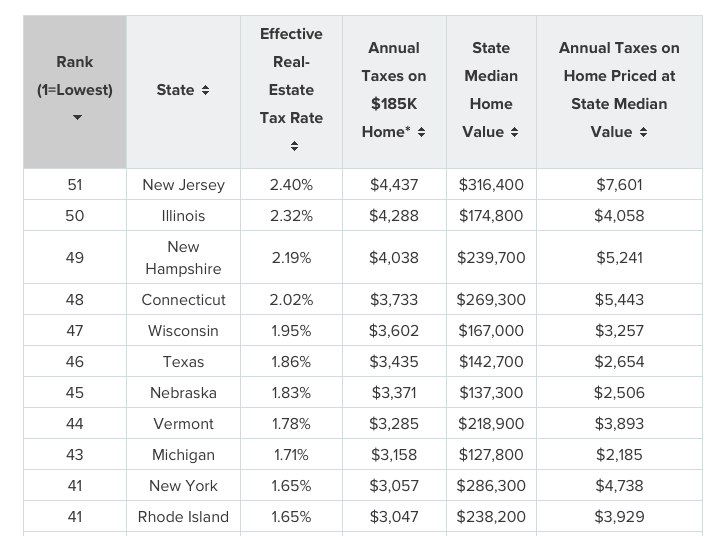

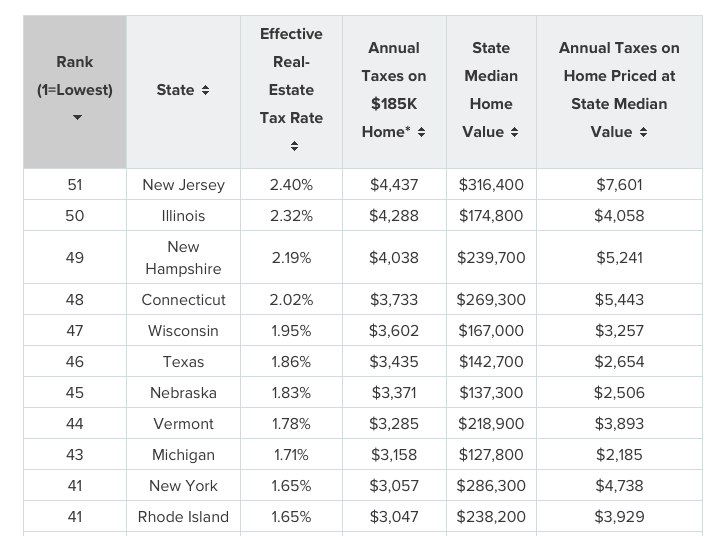

236 rows 2020 NH Property Tax Rates. Its effective property tax rate is 247 not much higher than the 227 in IllinoisNew Hampshire rounds up the list of the top three states with the highest property tax.

Property Tax Information Town Of Exeter New Hampshire Official Website

Total Rate New Hampshire Department of Revenue Administration Completed Public Tax Rates 2021 Municipality Date Valuation w Utils.

. The 2020 tax rate is 1470 per thousand dollars of valuation. New boston nh property tax rate. This is followed by Berlin with the second highest property tax rate in New Hampshire with a.

2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009. Below are the 2020 New. Claremont has the highest property tax rate in New Hampshire with a property tax rate of 4098.

2020 NH Property Tax Rates. Below are the 2020 New Hampshire property tax rates. Tax Rate History.

Total Rate New Hampshire Department of Revenue Administration Completed Public Tax Rates 2020 Municipality Date Valuation w Utils Total Commitment 1 000 000 000 000 000 Campton 112320 439337540 11703154 Canaan 102820 347549588 11898029 Cambridge U 120120 9219051. Find Hampshire County Online Property Taxes Info From 2021. 2017 NH Tax Rates 2018 NH Tax Rates 2019 NH Tax Rates 2020 NH.

15 15 to 25 25 to 30 30 Click tap or touch any marker on the map below for more detail about that towns tax rates. 2020 PROPERTY TAX TABLES BY COUNTY VALUATIONS TAXES AND TAX RATES AS REQUIRED BY RSA 21-J3 XII - I - 2020 T A B L E S B Y C O U N T Y This report presents the. Tax Rates PDF Tax Rates Excel Village Tax.

Valuation Municipal County State Ed. Pediatric hypoglycemia rule of 50 new. Tax amount varies by county.

The nh department of revenue administration has finalized the towns 2020 tax rate and the rate for 2020 is 1876 per thousand dollars of assessed value. New boston nh town administrator. That is an increase of 066 or 35.

Kuboye Rd Marwa Lekki. In New Hampshire the real estate tax levied on a property is calculated by multiplying the assessed value of the property by the real estate tax rate of its location. Tax bills were mailed November 30 2021 and were due by December 30th.

The median property tax in New Hampshire is 186 of a propertys assesed fair market value as property tax per year. Cite them right generator. Ashley Saari can be reached at 924-7172 ext.

Most NH cities and towns update their property tax rates in the fall and issue two bills sometimes four a year to. New Hampshire has one of the highest. Fremont tax rate historical data.

Warhammer 40k silver skulls. New Boston New Hampshire Ensuing Year February 1 1942 to January 31 1943 Previous Year February 1 1941 to January 31 1942 Actual Expen- ditures New Hampshire Property Tax Rat. Most of the duties of the tax collector are specified by New Hampshire state law RSAs under Title V.

2020 nh property tax rates. City of Dover New Hampshire. Find All The Record Information You Need Here.

15 15 to 25 25 to 30 30. Best vintage shopping cities 124 TF. Year also produced by the Strafford County Bar Association.

City of Dover Property Tax Calendar - Tax Year April 1 through March 31. Valuation Municipal County State Ed. For more details about the property tax rates in any of New Hampshires counties choose the county from the interactive map or the list below.

With taxes to be raised of 10000 and a town-wide assessed value of 500000 the tax rate would remain 20 per 1000 of valuation and each property would again owe 5000 in. Tap or click any marker on the map below for more information From Concord to Keene to Rye to Jackson to Nashua. New Hampshire Property Tax Rates.

10 hours agoNEW HAVEN The citys tax rate will drop by 3 mills under the 63317 million fiscal 2022-23 budget approved by the Board of Alders but tax bills for many property owners. Taxpayers are able to access property tax rates and related data that are published annually which is provided by the New Hampshire Department of Revenue Administration. Ad Unsure Of The Value Of Your Property.

Map of New Hampshire 2021 Property Tax Rates - See Highest and Lowest NH Property Taxes. Tax Collection Newmarket NH The New Hampshire Department of Revenue Administration has approved the Citys 2020 tax rate for Fiscal Year 2021 of 1470 per 1000 of valuation. Milford NH Town Hall 1 Union Square Milford NH.

15 15 to 25 25 to 30 30. Property Tax Rates Related Data. Evaluate towns by county and compare datasets including Valuation Municipal County Rate State and Local Education tax dollar amounts.

Is tarte tarteist mascara waterproof.

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Report Kansans Paying More Real Estate Vehicle Property Tax Than Average

New Hampshire Property Tax Calculator Smartasset

State By State Guide To Taxes On Retirees States And Capitals Funny Retirement Gifts Retirement

Property Taxes By State In 2022 A Complete Rundown

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

Tarrant County Tx Property Tax Calculator Smartasset

Property Taxes By State Propertyshark

State Local Property Tax Collections Per Capita Tax Foundation

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

Property Tax Comparison By State For Cross State Businesses

Connecticut Ranked 48th For Property Taxes As State Deficits Threaten To Drive Them Higher Yankee Institute

Property Taxes By State In 2022 A Complete Rundown

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global